irs federal income tax brackets 2022

10 12 22 24 32 35 and a top bracket of 37. It is taxed at 10 which means the first 9950 of the.

Where S My Refund The Irs Refund Schedule 2022 Check City

There are seven federal tax brackets for the 2021 tax year.

. Married Individuals Filing Separate Returns. If a corporation has a net operating loss NOL for a tax year the limit of 65 or 50 of taxable income does not apply. Married Filing Jointly or Qualifying Widower Married Filing Separately.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. These are the rates for. To determine whether a corporation has an NOL figure the dividends.

Taxable income up to 10275. Although this publication may be used in certain situations to figure federal income tax withholding on supplemental wages the methods of withholding described in this publication. 2022 Tax Brackets.

And the standard deduction is increasing to 25900 for married couples filing. The IRS has set seven tax brackets 2022 taxpayers will fall into. 35 for incomes over 215950 431900 for.

Unmarried Individuals other than surviving spouses and heads of households. For 2018 there is a still a 10 bracket and only a small change to the cutoff amounts for that bracket. Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket.

The IRS did not change the federal tax brackets for 2022 from what they were in 2021. Notice 2022-35 page 184. 2021 Tax Brackets Due April 15 2022 Tax rate Single filers Married filing jointly Married filing separately Head of household.

2022 Federal Income Tax Brackets Heads of Households. Social security and Medicare tax for 2022. No the federal tax tables for 2022 will be the same as they were in 2021 because the Internal Revenue Service has not adjusted them.

The Kiddie Tax thresholds are increased to 1150 and 2300. Notice 2022-35 provides guidance on the corporate bond monthly yield curve the corresponding spot segment rates used under 417 e 3 and. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts. The refundable portion of the Child Tax Credit has increased to 1500. The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave.

Taxable income between 41775 to 89075. Taxable income between 10275 to 41775. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Your bracket depends on your taxable income and filing status. Whether you are single a head of household married. The lowest tax bracket or the lowest income level is 0 to 9950.

Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. The other brackets have all changed and now include the following. 10 12 22 24 32 35 and 37.

Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. There are still seven in total. The standard deduction for married couples filing jointly for tax year.

There are still a total of seven.

2020 Federal Income Tax Brackets

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

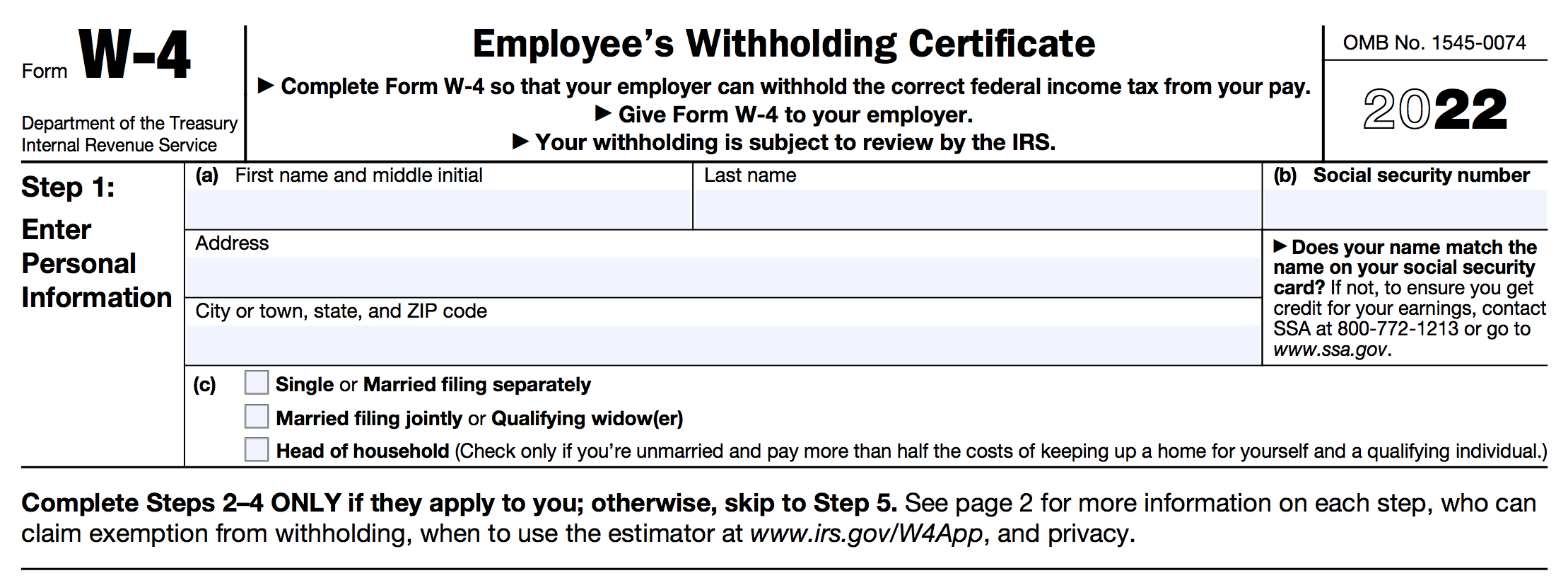

What Is The W 4 Form Here S Your Simple Guide Smartasset

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2022 Tax Inflation Adjustments Released By Irs

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans The White House

2021 Tax Brackets 2021 Federal Income Tax Brackets Rates

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Inflation Pushes Income Tax Brackets Higher For 2022

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

![]()

Here S How To Track Your 2021 Federal Income Tax Refund

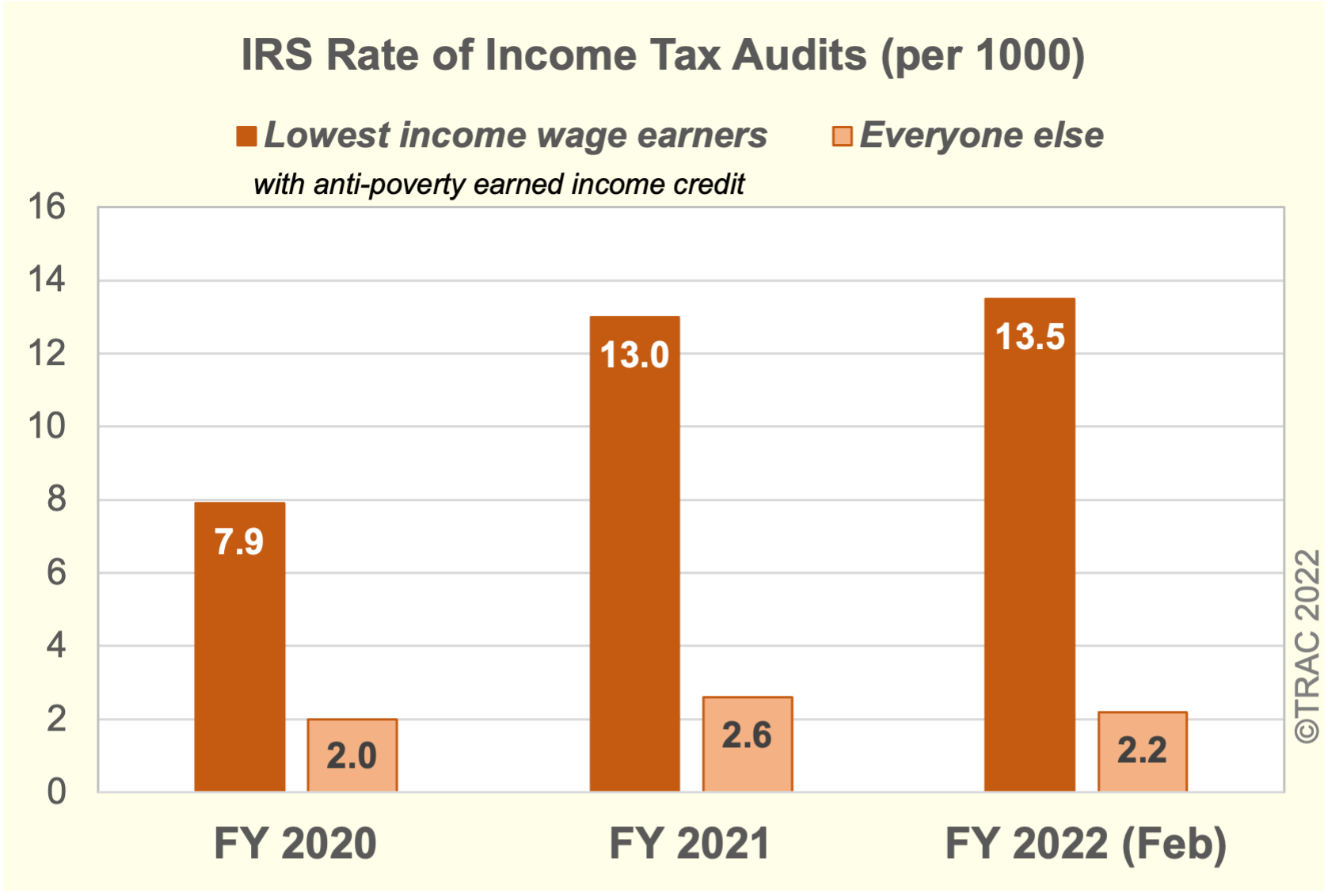

Irs Continues Targeting Poorest Families For More Tax Audits During Fy 2022

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)